4 May 2022 By May Ng

2022 Phuket Real Estate Market At A Glance

BANGKOK – Phuket found itself in 2021 with few international tourist arrivals, no new condominium projects, and only two villa projects launched. However, CBRE Thailand, the leading international property consultant, reports a slight increase in demand for resort homes and performance recovery for hotels as travel restrictions ease and regulations adjust.

Ms. Prakaipeth Meechoosarn, Head of Phuket Property Sales at CBRE Thailand commented, “The Phuket Sandbox model launched in July 2021 may not have worked out as well as we had hoped. However, in H2 2021, we saw an increase in foreign tourist arrivals at Phuket International Airport, to 219,144. While that was low compared with 4.4 million arrivals in H2 2019, the Phuket property market picked up due to long-stay overseas visitors and demand for luxury villas from Bangkok-based Thais and expatriates.”

“Since the beginning of 2022, we have sold several villas to local buyers looking for luxury resort homes in Phuket. We believe the luxury villa market will continue to do well because buyers are looking for flexible working space and a safe haven for their family’s privacy. Further pent-up demand came from Thai and foreign clients seeking opportunities to buy Phuket properties on sale at special prices, both condominiums and single houses, which are on sale at lower prices because previous owners either couldn’t return to the island due to COVID-19 or they wanted to unload their assets.”

Moreover, Chinese and Russian investors are largely absent from the Phuket condominium market due to travel restrictions and the ongoing international conflict. If these groups return, we may see a wider market for both groups, including both investment and own-use buyers. Meanwhile, the Chinese market will be a challenge for developers with limit restrictions on bank transfers. Nonetheless, developers with Chinese joint ventures may have an advantage with bank transfers and greater confidence in projects.

CBRE sees two potential groups of Chinese buyers for Phuket; firstly, the investor market seeking guaranteed yields and tenancy management, and secondly, end-user buyers seeking luxury villas as holiday homes with possible leasing opportunities.

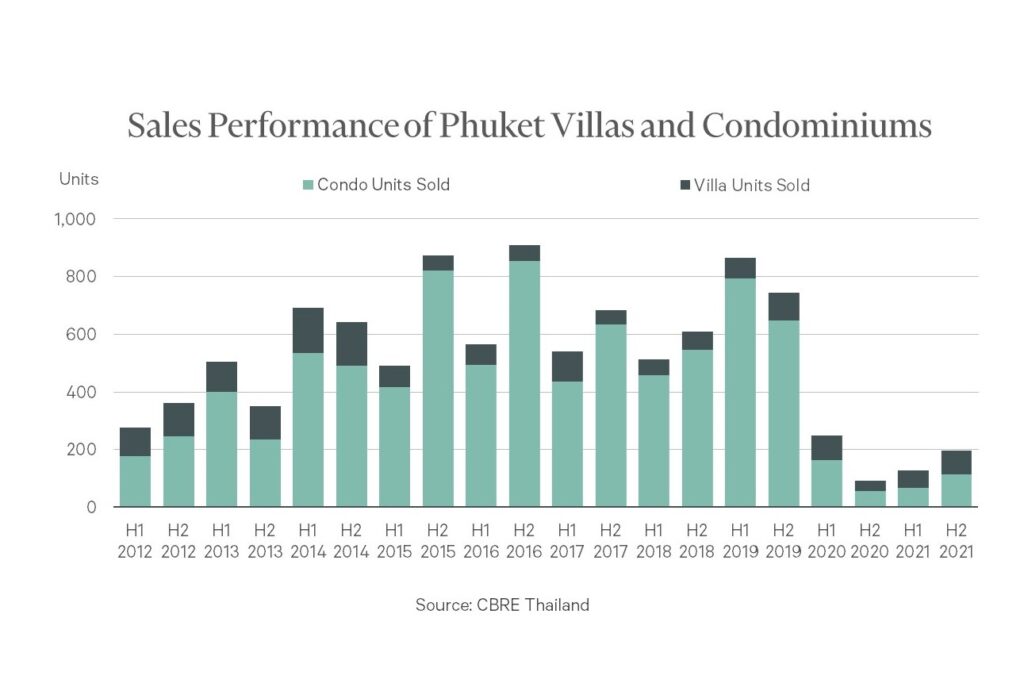

For the Phuket condominium and apartment market, 115 units were sold in H2 2021, an increase of 113% Y-o-Y from only 54 units in H2 2020 or 74.2% H-o-H from 66 units in H1 2021, according to CBRE Research. No new condominium projects were launched for two consecutive years since H2 2019, while 209 newly completed units came from one project. More than 4,700 units are in the pipeline for completion by 2023, mostly located in the Central West Coast and Southwest Coast.

Looking at the Phuket villa market, CBRE Research found a total of 81 villas were sold in H2 2021, increasing 32.8% H-o-H and 125% Y-o-Y. Sales performance also increased quarter on quarter as there were 36 units sold in Q3 2021 and 45 units sold in Q4 2021. This was influenced by the impact of COVID-19, as strong demand came from local buyers looking for resort homes and second homes. The 2022 outlook for the Phuket villa market is more positive than previous years, but a sustained recovery is harder to predict.

Sales Performance of Phuket Villas and Condominiums

On the Phuket hotel supply side, CBRE Research reports 1,180 keys were added in H2 2021 from nine new hotel openings, rounding the total supply of the island’s hotels to almost 43,000 keys. With the increased stream of international tourist arrivals to Thailand, the STR occupancy rate in H2 2021 also improved at 16.8% from 8.5% Y-o-Y. By 2024, the Phuket hotel supply is expected to increase by 7.3%, from 15 under-construction hotel projects with a total of 3,120 keys.

Mr. Atakawee Choosang, Head of Hotels, CBRE Thailand, added, “The Phuket hotel market has also seen improvement from increased vaccination rates, travel confidence, and government schemes that promote domestic travel, and adjustments to international entry policies. This has resulted in an increase in international tourist arrivals compared with 2020. So far in Q1, Phuket hotel occupancy rates have rebounded strongly, driving COVID-19 occupancy rates to 60% – 90% levels for hotels surveyed in February, yet revenue per available room (RevPAR) continues to struggle as owners continue to offer special rate packages to entice guests to return.”

“With the borders being closed to Chinese inbound, the predominant tourist segment has been Europeans, Americans, and Russians who are now left stranded due to the ongoing conflict. Additionally, with the latest COVID-19 surge in China, it will be challenging to get a consistent buy-in for Chinese travelers to potentially leave China and enter Thailand,” concluded Mr. Atakawee

/